Constituents often ask about the tax revenue from cannabis and wonder why it hasn’t done more to boost the state budget, as was promised by many of the proponents of legalization at the time. The December report on state revenues from the Commission on Government Forecasting and Accountability (CGFA) included a closer look at cannabis revenue.

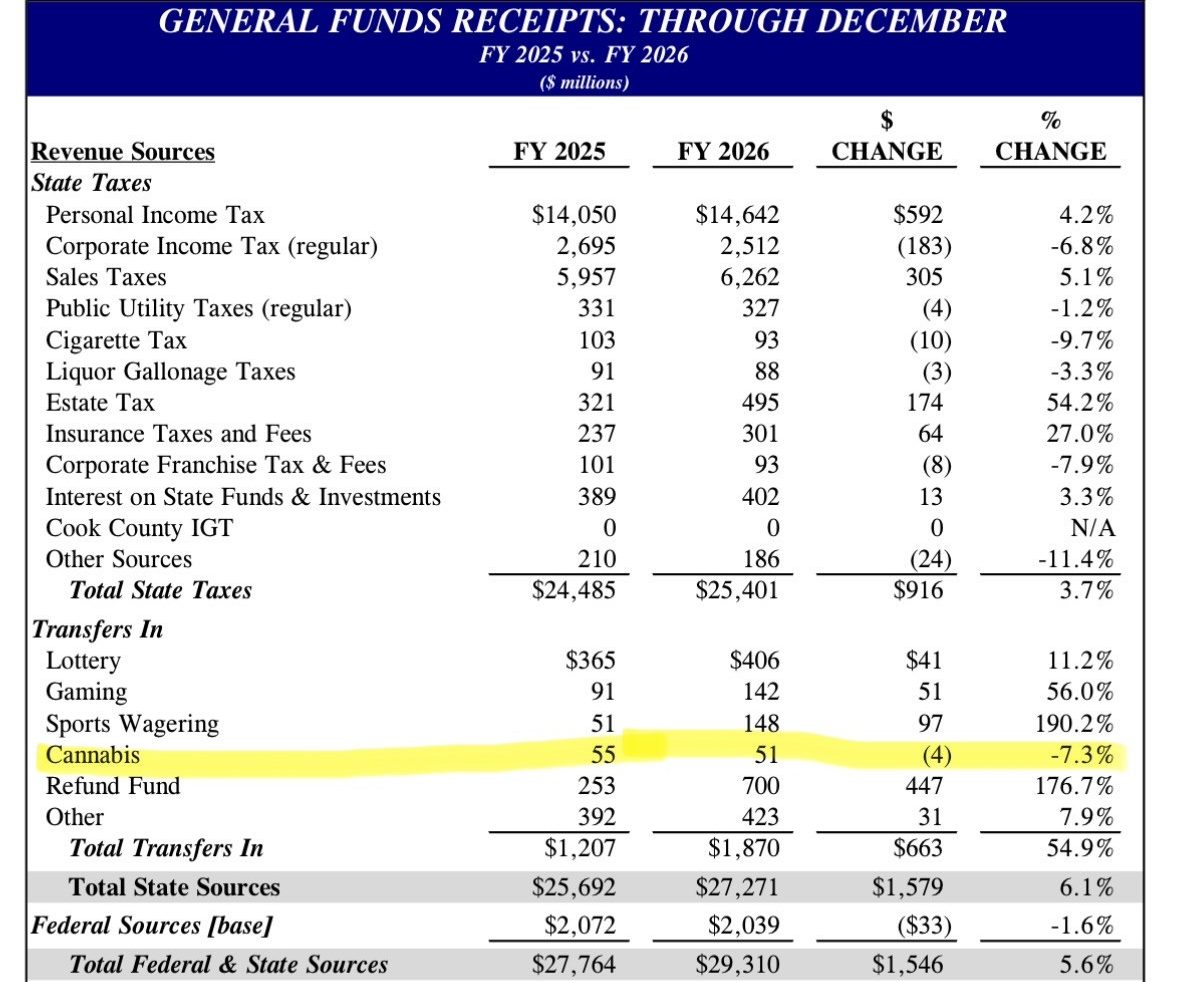

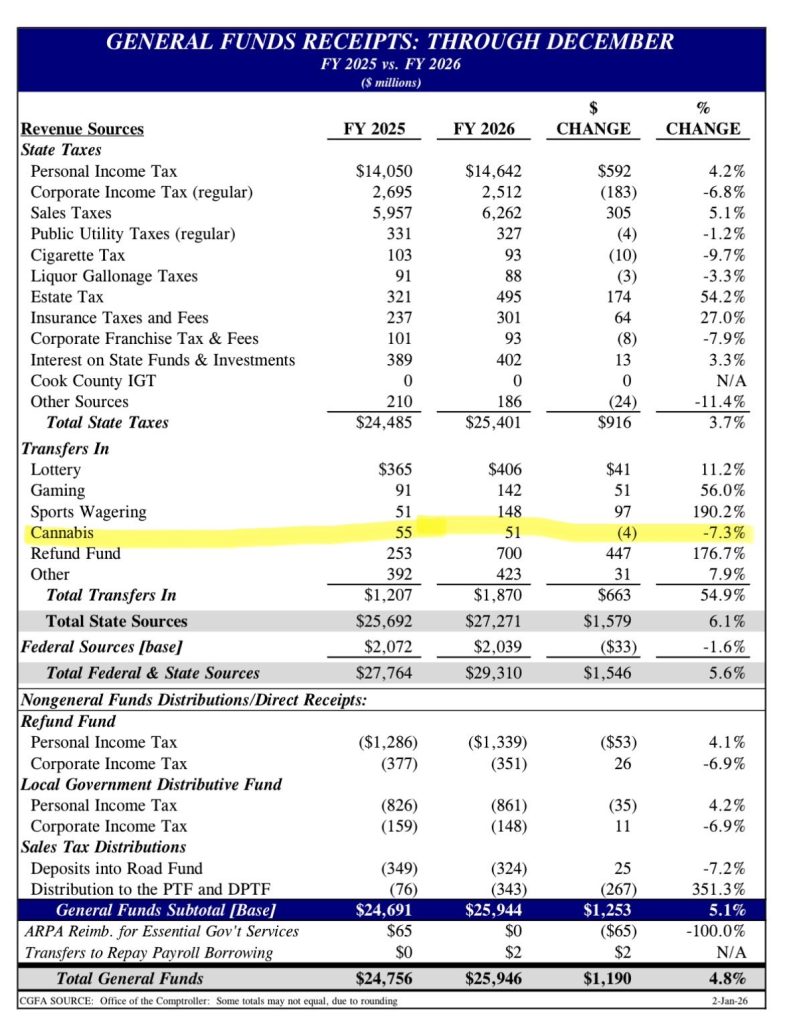

The image above compares revenues in IL’s General Fund for the first six months of the FY25 budget compared to the current FY26 budget. As you can see highlighted, only $51 million of more than $29 billion in state General Fund revenues has come from cannabis taxes for the first six months of FY26.

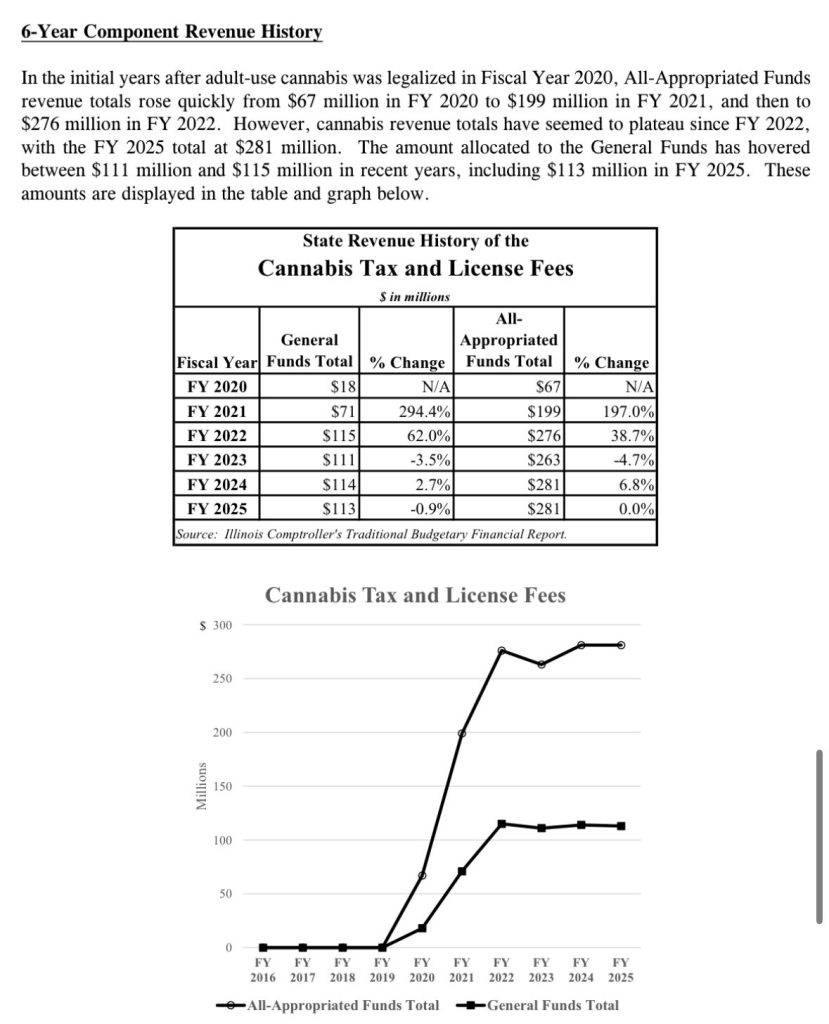

As the next image illustrates, cannabis taxes have somewhat plateaued since 2022, bringing in no more than $281 annually to all appropriated funds. (Note: sales of cannabis are also subject to the state sales tax and local taxes, adding those in increases FY25 revenue to $471 million).

To put it into perspective, with a $55 billion state budget for FY26, only 0.5% of state tax revenue is coming in from cannabis taxes (it’s still only 0.8% if you include the regular state sales tax and local tax collections).

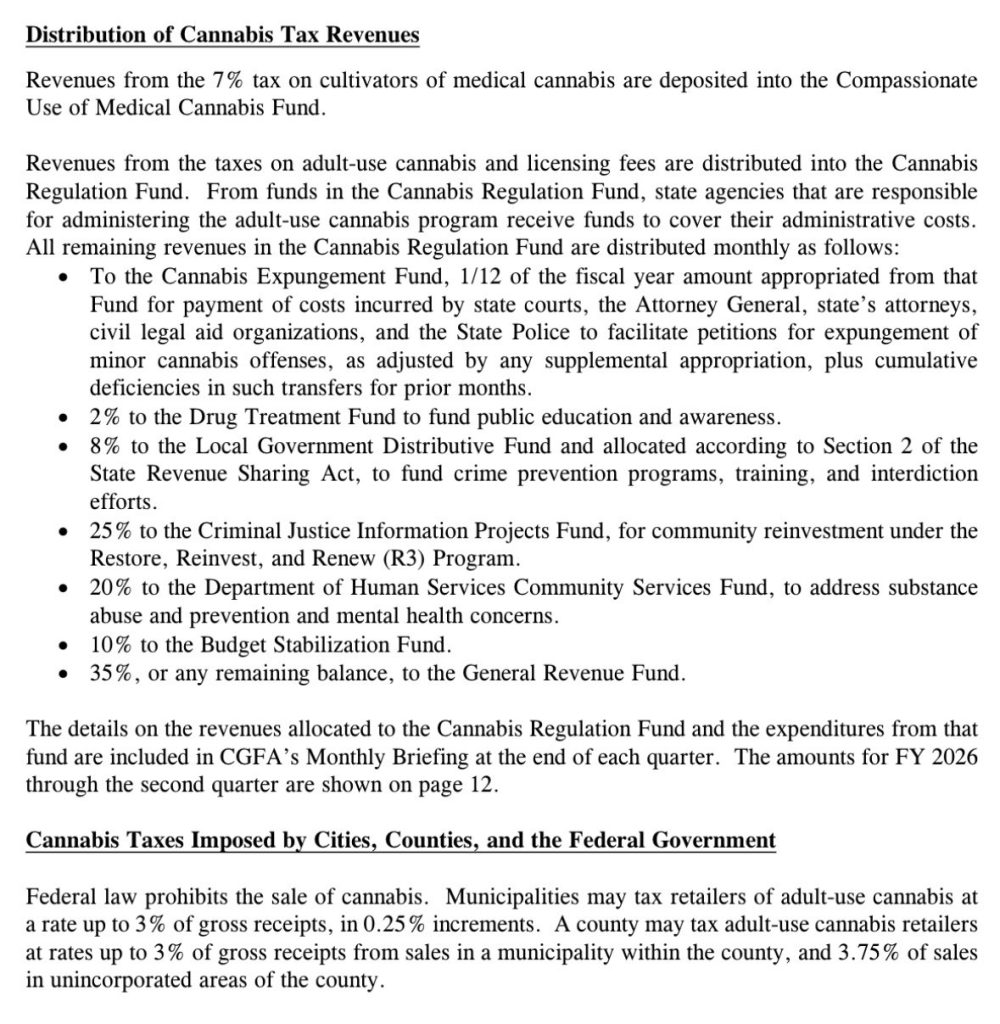

The final image breaks down where the money from cannabis taxes goes.

The simple answer is that, despite high taxes on cannabis, the revenue is barely a drop in the bucket.

Download the full December CGFA report below or Click Here to visit CGFA website.